Most important snack:

- O1. Exchange increased 4.2 million US dollars led in a round of financing by Coinbase Ventures And Alliancedao.

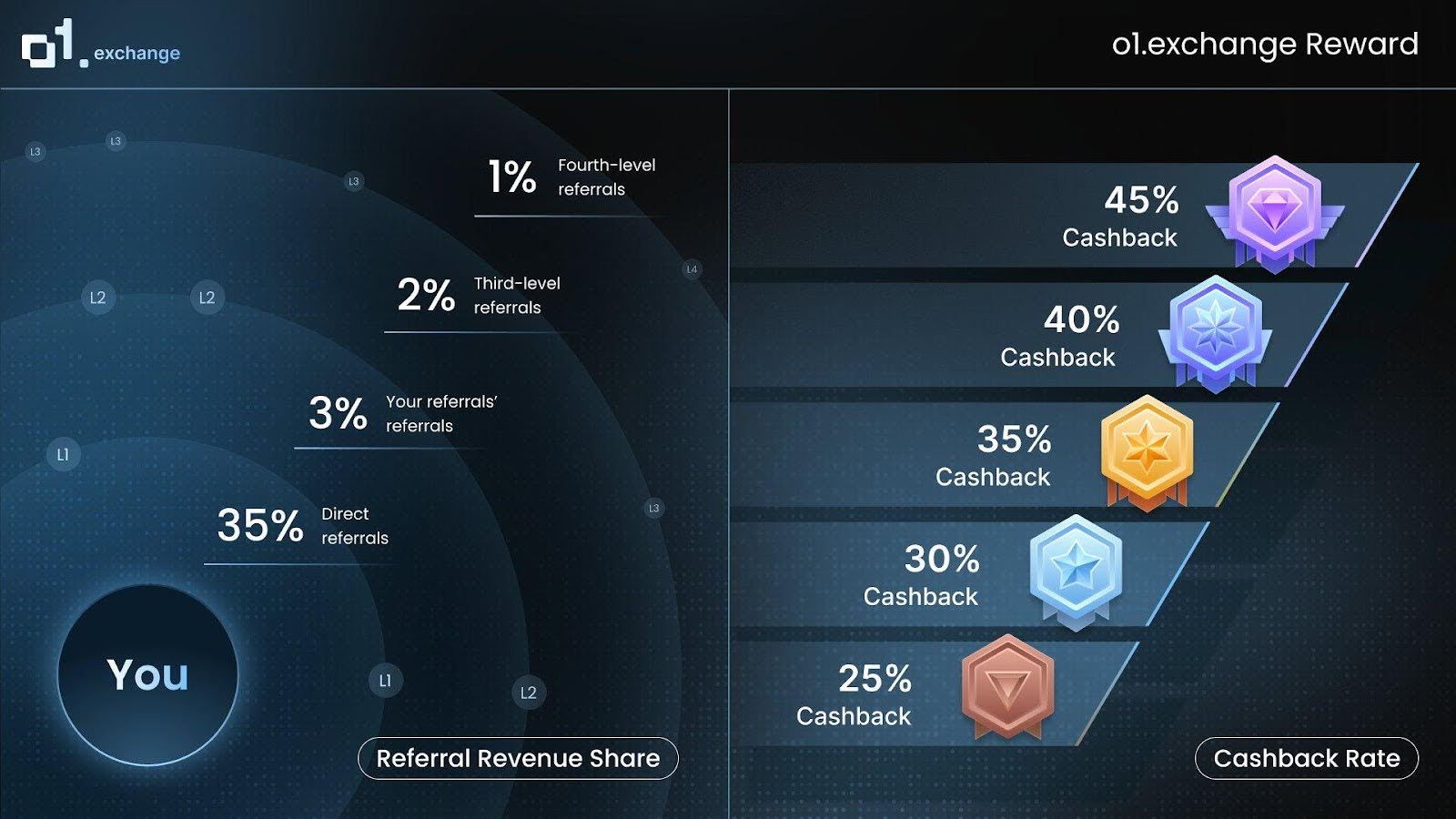

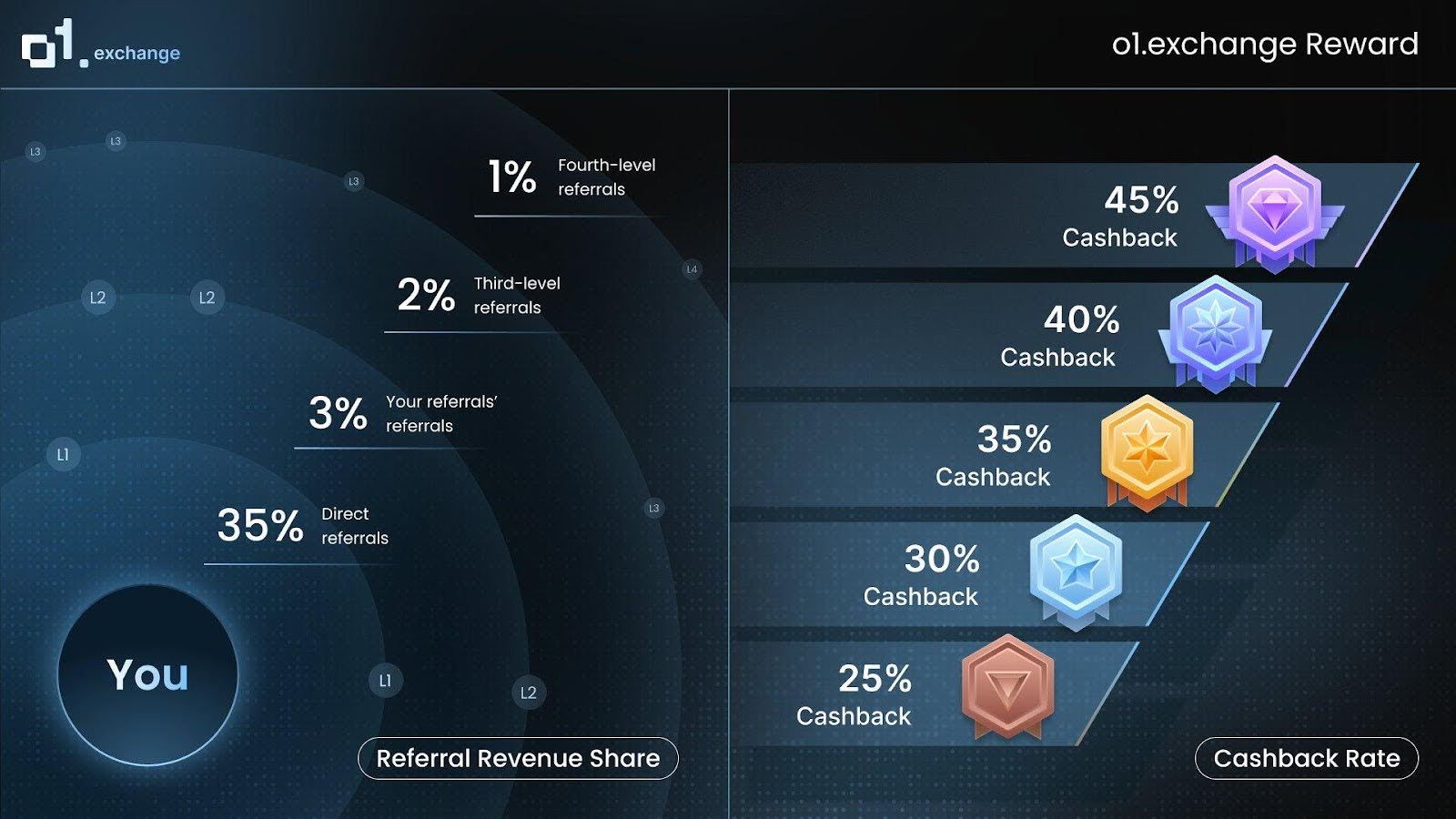

- The platform leads a 45% cashback program And 41% transfer sales share Promotion of user acceptance.

- The functions include On-chain trading connectionPresent Tradingview Enterprise diagramPresent Multi-Wallet managementAnd Fastest trade version at ≤ 1 block.

The base ecosystem has just got a large thrust. O1.Exchange, which describes itself as the first trading deadline based on the base, has announced A round of financing of 4.2 million US dollars and the introduction of an aggressive cashback and recommendation premium program. Supported by Coinbase Ventures and Alliancedao, the platform aims to set a new benchmark for the decentralized trade infrastructure.

Financing round: A strategic thrust for the base

The increase in funds to $ 4.2 million ensures O1. Also as one of the best financed projects in base ecology. The fact that the overarching ecosystem base will be involved directly in the success and credibility of the project will arouse the willingness of Coinbase to lead the round. The support also has a strategic depth, since Alliancedao is also an incubator who works with top-class crypto startups.

This new financing round is used to accelerate the pace of the structure of the supply companies to accelerate the O1 exchange trading platform, to integrate into integration with leading protocols and to start reward systems in order to address both retail dealers and professional market participants.

The investment is also an indication of the emerging desire of risk companies to invest in projects at infrastructure level within the base, in particular in the potential, liquidity, transparency and efficiency in the execution.

Key features of the O1.ExChange retail connection

Advanced on-chain functions

O1.Exchange positions itself as a “Bloomberg Terminal for Base” and offers a number of tools that are rarely seen in decentralized environments. This includes:

- On-chain data analysis: Aggregated Dex data and pocket tracking in real time.

- Tradingview Enterprise diagram: Dealers can expand candlestick data to check detailed trade currents in certain time frames.

- Advanced order types: Limit orders, sniping and Twap (time -weight average price) execution strategies.

- Executional speed: Trades collect in a block or lessMinimization of the slip.

This focus on the execution speed is particularly remarkable. In decentralized markets, transaction delays can undermine profitability. Due to promising ≤ 1 block version, O1. Exchange not only competes with DEX interfaces, but also with some centralized stock exchanges in terms of reaction.

Waser pocket and multi -chain support

Multi-wallet management is possible in the platform and has a self-evident wallet that, together, certainly offers easy use. It has built-in cross-chain support and bridging functions that enable the mobility of assets.

The compatibility with almost all base launchpad projects such as Zora, BaseApp, Virtuals and Clankeronbase has another synergy layer on the ecosystem. The liquidity access and sophisticated order functions are also made possible aggressively by partnerships with Uniswap V4.

Read more: The failure of the basic network increases red flags over the centralized sequencer design

Incentive programs: cashback and recommendations

The most impressive announcement besides the news about the financing is that it started an ambitious cashback and recommendation program:

- 45% cashback rate: Dealers return almost 50% of the invited trade fees, a level that is much higher than most of their centralized or decentralized competitors can do to pay them.

- 41% transfer sales share: First makers and customers can earn money with their networks, which can lead to viral growth.

This type of aggressive incentive should lead to board users in a flooded Defi market at a quick pace on board users. With the competition through platforms around Ethereum, Solana and other L2 networks, O1.

Competition landscape: Why is that important

While the meme token and the NFT have exploded in the base, the trade infrastructure in the network is still relatively underdeveloped. Immediate access to a variety of tools has the priority of most dealers who still use conventional Dex interfaces.

By determining an integrated end -to -end terminal with functions of the company level, O1. Exchange is noticeable among other basic projects. Its tactics are similar to a similar situation of Binance or FTX in the first phases of their development using highly developed trade features and rewards to be ahead of the competition.

Provided that it works, O1. Exchange can become a hub in which serious dealers act in the base, creating liquidity and the market becomes deeper and more mature.

Layer-2 networks such as the basis, arbitrum and optimism can be found in the institutional players. These ecosystems are appealing in their scaled, interoperable, scalable nature and high -quality trade and structured financial products.

Read more: JPMorgan unleashed JPMD on the basis: The courageous jump of the 4 -t banking giants in the public crypto rails of the 4T banking range